Where are the potentials that make our company successful?

Does market capitalization really show the value of a company?

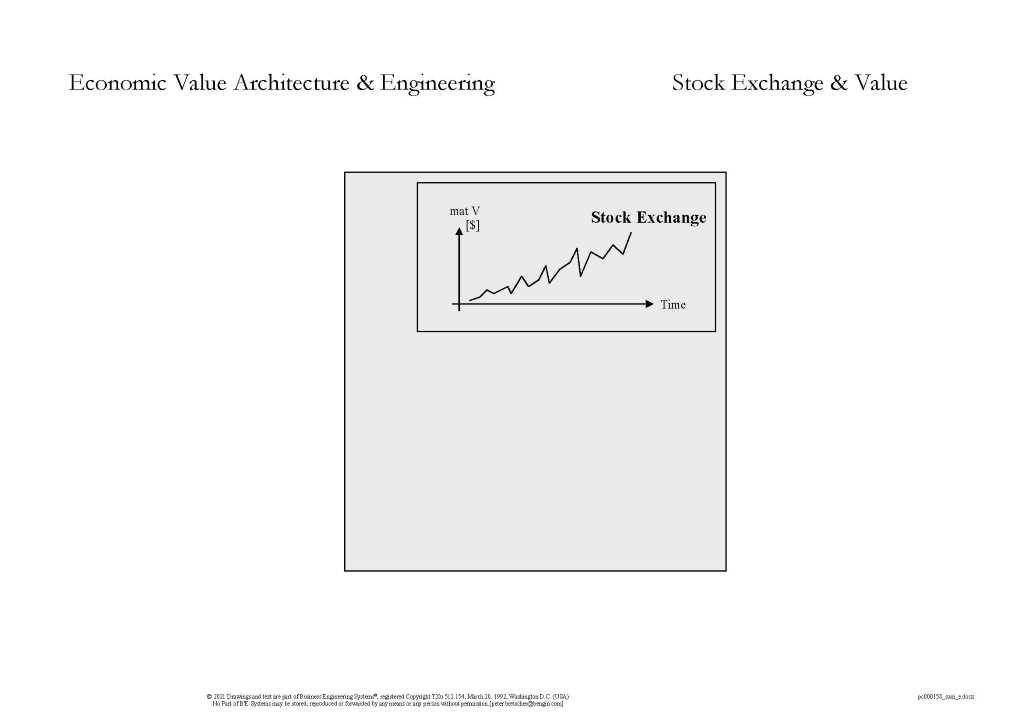

How meaningful are the indicators from the balance sheet and income statement?

How can you manage a large company at all if the most important resources today - the skills of the employees - do not even appear in the management tools?

What do sustainably oriented entrepreneurs and investors look for?

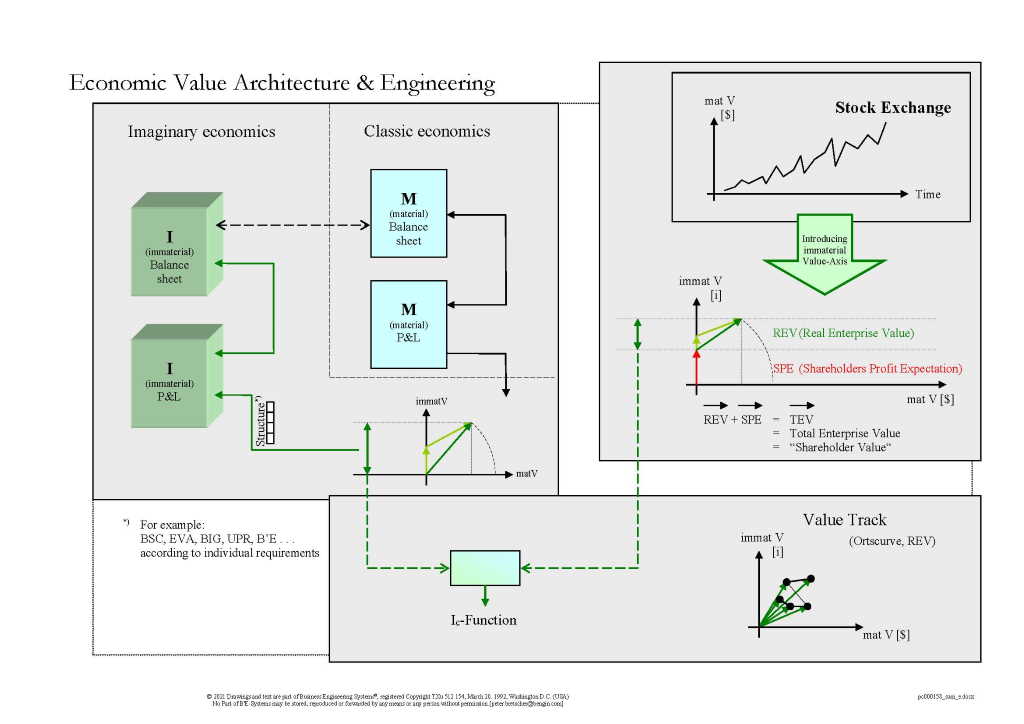

We believe there is a need to catch up on the tools that can be used to map the entrepreneurial resources and potentials that are important today.

This makes it easier for entrepreneurs and managers to cultivate these values more sustainably and make them usable. But also in reporting, the values, potentials and perspectives can be shown more completely to shareholders and investors.

The knowledge of the intangible potentials gives decisively more security on all levels and with all shareholders and stakeholders.

The visualizations below can be downloaded as a pdf via THIS Link.

"Many of the patterns of economy (he said nature) we can discover only after they have been constructed by our mind."

Friedrich von Hayek

"I often say that when you can measure what you are speaking about and express it in numbers you know something about it; but when you cannot measure it, when you cannot express it in numbers, your knowledge is of a meager and unsatisfactory kind: it may be the beginning of knowledge, but you have scarcely, in your thoughts, advanced to the stage of science, whatever the matter may be."

Lord Kelvin, Electrical Units of Measurement, 1883

Exploring the Energy that Powers the Value of your Enterprise

2.2 Intangible assets

If there are intangible assets such as experience, knowledge, skill.... - and they are becoming increasingly important in a smart economy - it might not be silly to map them.

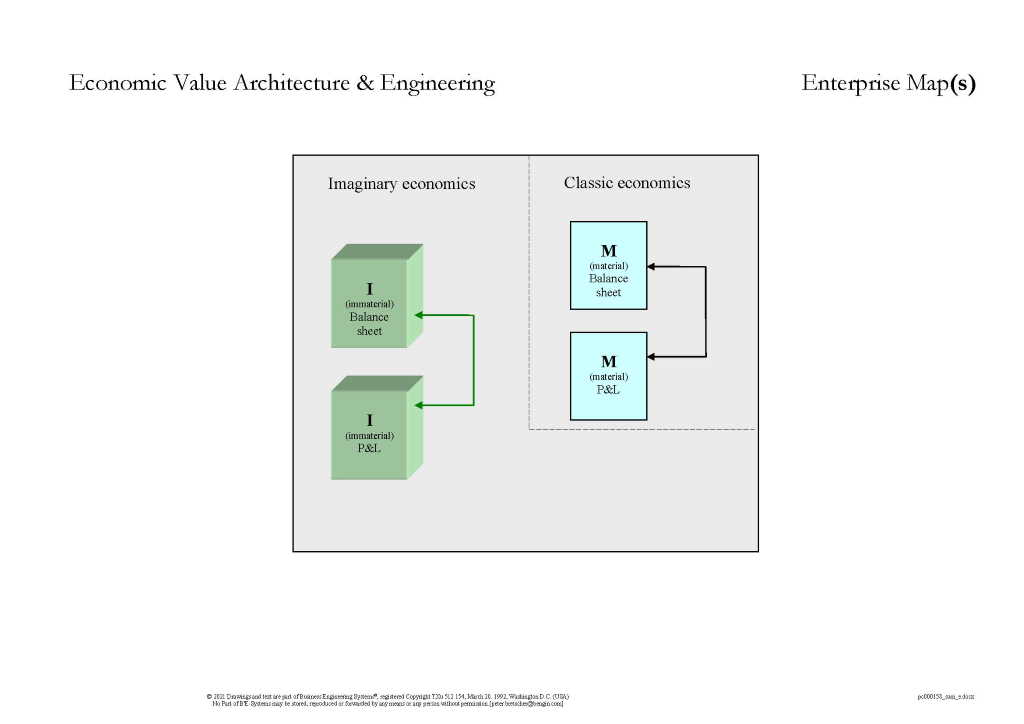

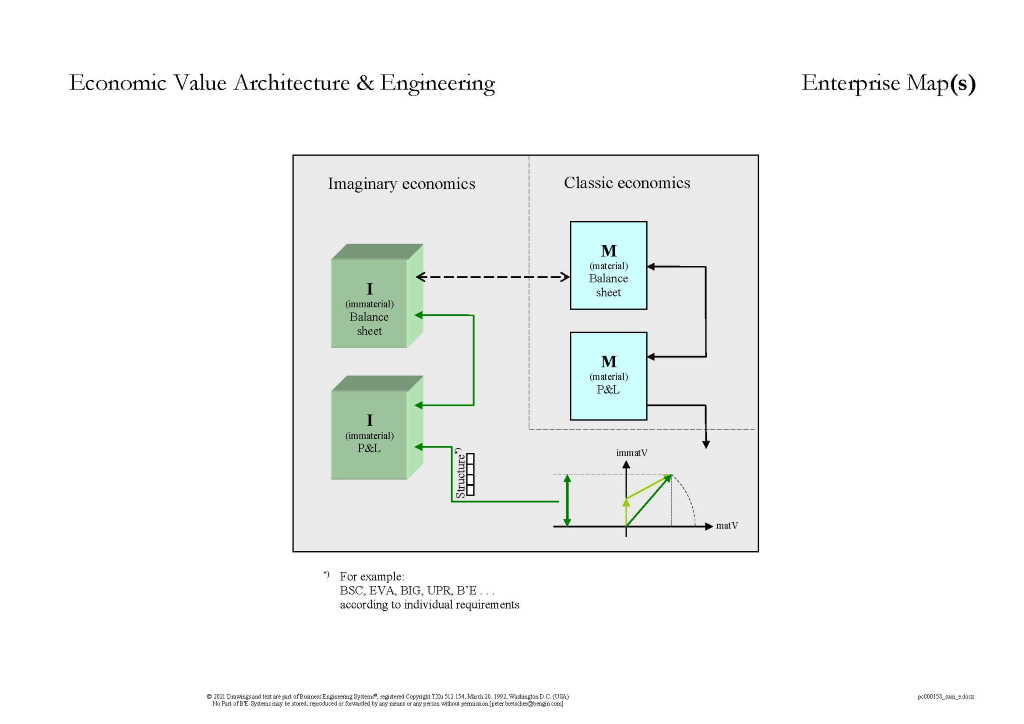

2.2 map

Structuring and quantifying is part of any cartographic activity. And yes - there are already various proposals on how to structure this reality. In the balanced scorecard, for example. Or make a structure that is most suitable for your company. These values can be quantified by introducing a subjective, imaginary value axis.

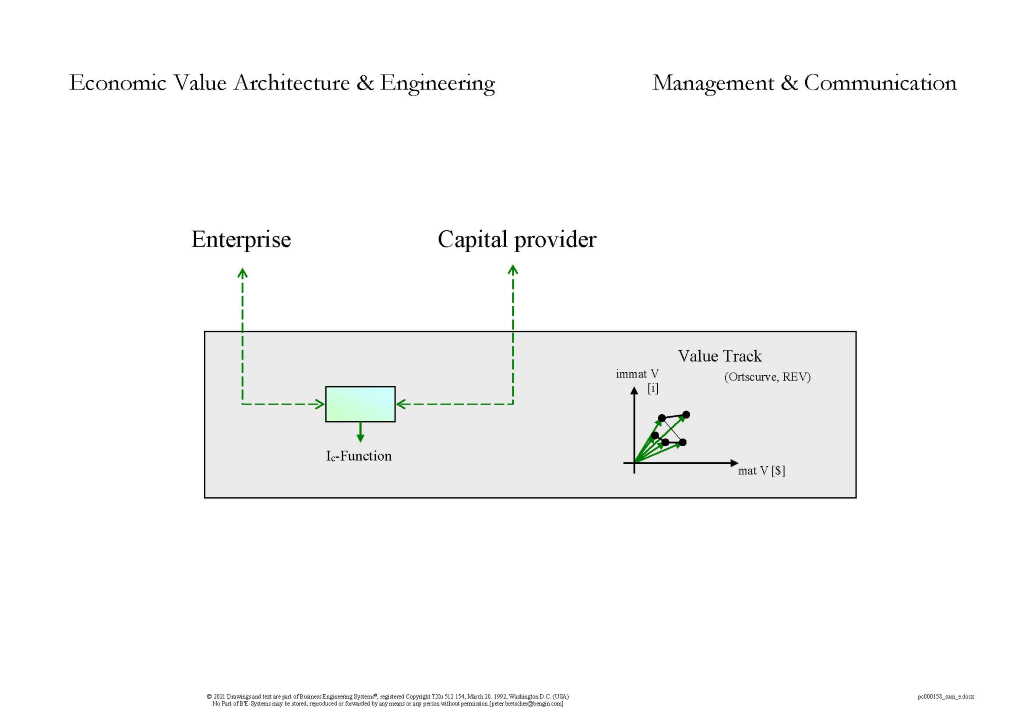

3.2 Value Track

If the intangible values are plotted on a second value axis, the CEO can show the "internal value creation" (= potential = economic energy) in the company compared with the external "monetary value creation". Only the combination of these two value creations allows the manager and the investor to make an integral assessment of the value of a company.