Introduction

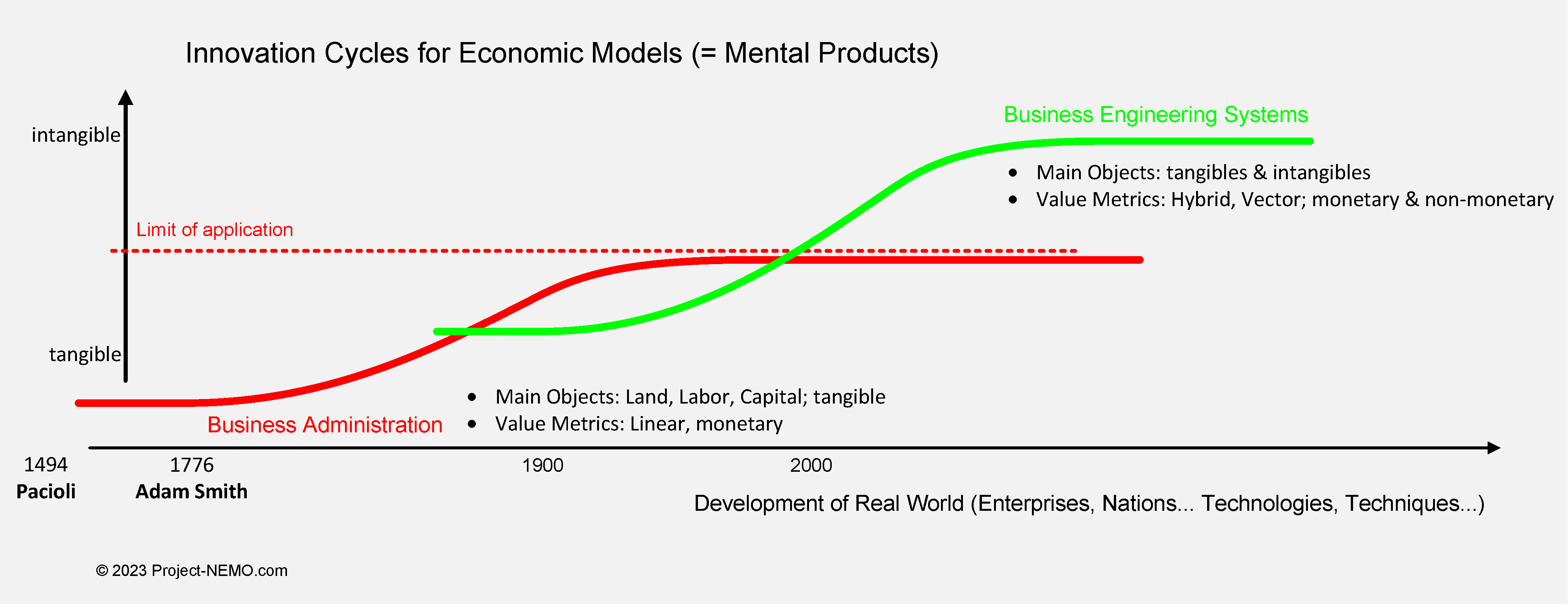

In a rapidly evolving global economy, traditional models of business administration are facing a crisis of relevance. The classic ‚Business Administration‘ paradigm, while once effective, no longer adequately captures the complexity and intricacies of modern business environments. The need for innovation in this arena has given rise to ‚Business Engineering Systems,‘ a new and revolutionary approach that promises to reshape the way we understand and manage businesses.

Thesis Statement

This essay argues that replacing the classic ‚Business Administration‘ with ‚Business Engineering Systems‘ is not just necessary but imperative. The new model’s integration of intangible assets, hybrid value models, and a holistic approach to economic analysis addresses critical gaps in traditional models, offering a more comprehensive, adaptable, and forward-thinking framework.

The Imperative for Change

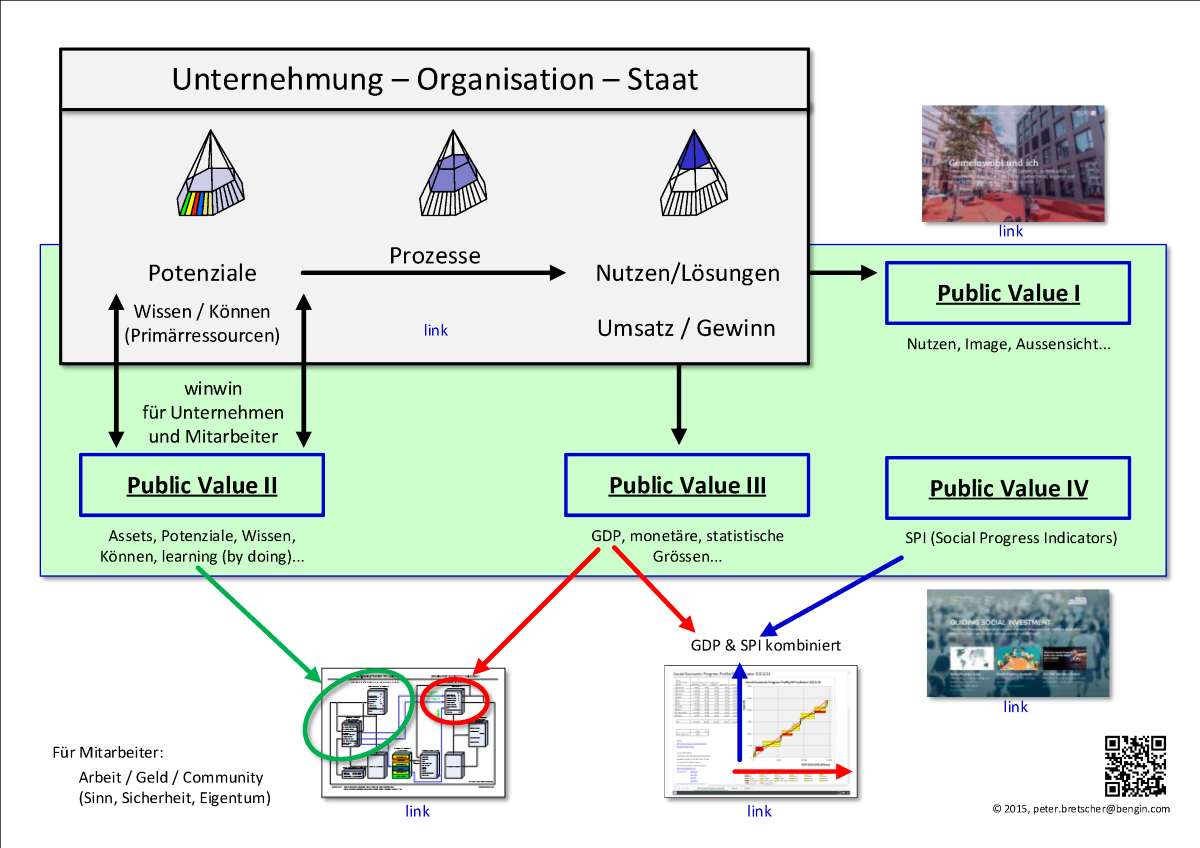

- Integration of Intangible Assets: In the old model, intangible assets like employee knowledge and skills were often overlooked or undervalued. ‚Business Engineering Systems‘ recognizes the immense value of these assets, treating them as crucial components of the business landscape.

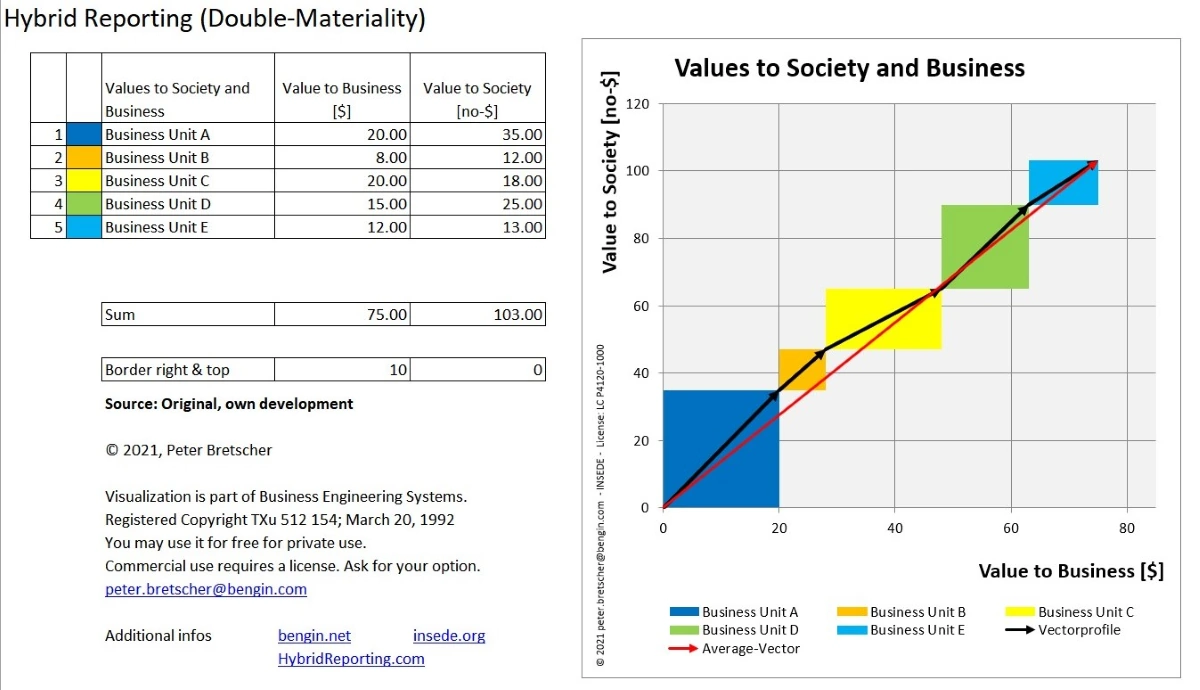

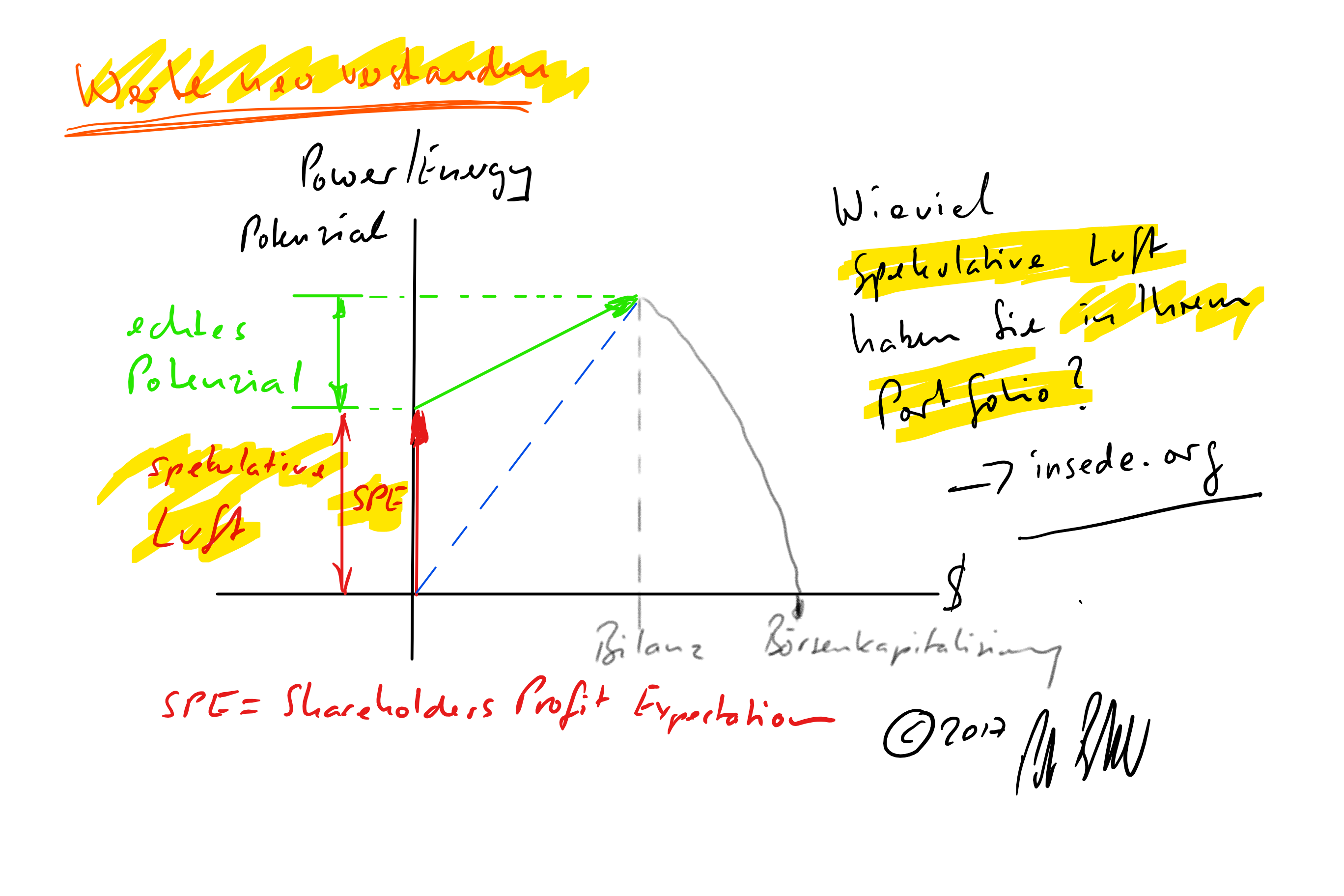

- Hybrid Value Model: Traditional models often relied solely on monetary metrics for measuring value. The new model introduces a hybrid value model, accounting for both monetary and non-monetary indicators. This approach reflects the multifaceted nature of modern business, where value encompasses a diverse array of factors.

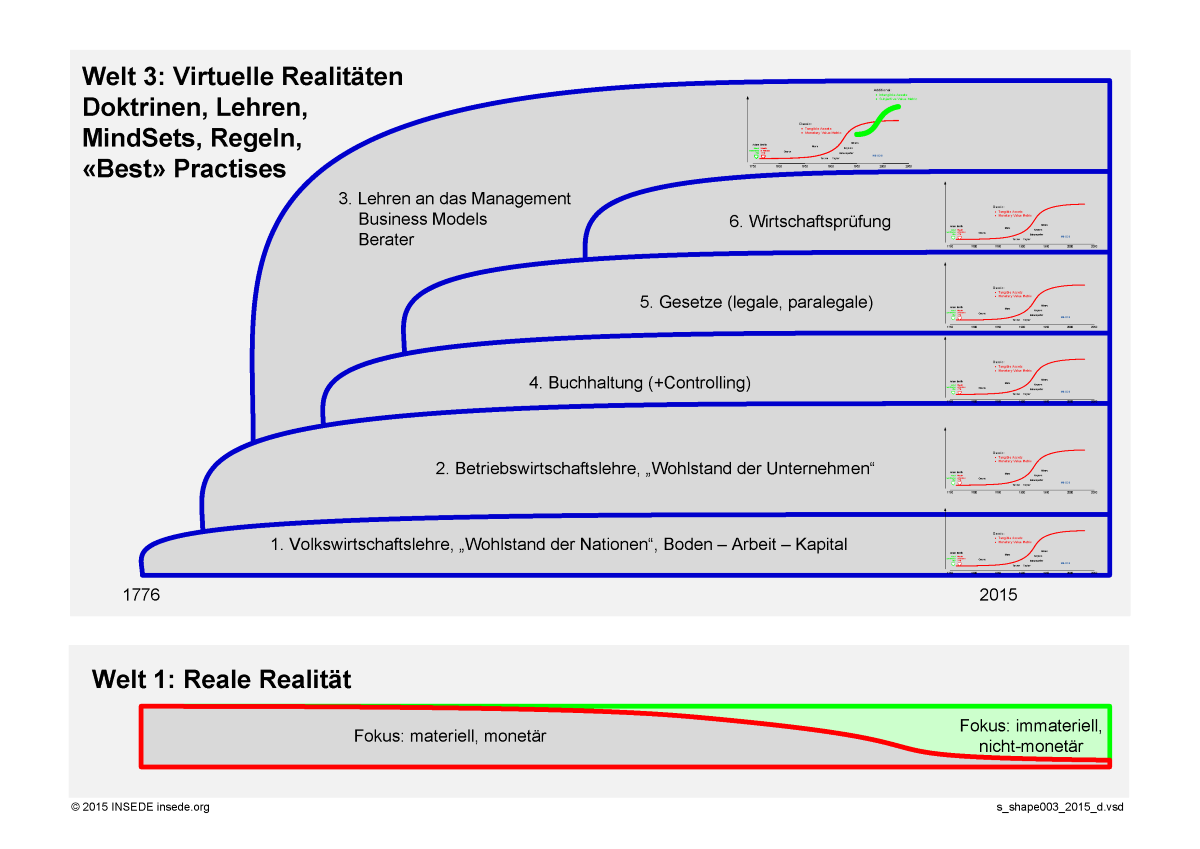

- Embracing Innovations: ‚Business Engineering Systems‘ mirrors the S-curve innovation approach seen in the development of physical objects. Recognizing that the old model has reached its saturation point, the new model paves the way for innovative solutions that were previously unattainable.

- Mental Model Innovations: Philosophers and quantitative sciences are integrated into the new model, combining subjective, qualitative science with objective metrics, standards, scales, and formulas. This fusion ensures a more holistic understanding of economic systems.

Challenges with Classic Models

- Historical Baggage: Traditional models, like those laid out by Pacioli and Adam Smith, have deep historical roots. However, these traditions often lead to stagnation and hinder adaptability to today’s rapidly changing business landscape.

- Systemic Errors: The old models have systemic errors at their foundations. The overemphasis on the production factor ‚capital‘ and its monetary measurement as the standard unit of economic value overlooks the significance of knowledge, skills, and intellectual property.

- Lack of Employee Recognition: Traditional teachings rarely account for the value of employee knowledge and skills, along with intellectual property. In today’s ‚intelligent‘ economy, these assets are vital and should be integrated into extended accounting practices.

The Promise of Business Engineering Systems

- Extensive Development: ‚Business Engineering Systems‘ is not a mere concept but the result of extensive preliminary work, with a development expenditure exceeding CHF 6.5 million. Its name was copyrighted in Washington in 1992, showcasing its commitment to a transformative vision.

- Compatibility and Adaptability: The new model is compatible with the old one, making the transition smoother. However, it offers far greater possibilities to represent the complexities of the modern business world, providing a smarter and more adaptable reality.

- Target Audience: ‚Business Engineering Systems‘ is designed for a wide audience, including managers, decision-makers, professors, consultants, and auditors. Its versatility and applicability make it a valuable tool across various industries and sectors.

Conclusion

In conclusion, the replacement of the classic ‚Business Administration‘ model with ‚Business Engineering Systems‘ is not just a matter of choice; it’s a necessity. The imperative for change is evident in the gaps and limitations of the traditional models. ‚Business Engineering Systems‘ brings innovation, adaptability, and a holistic approach to economic analysis, making it the blueprint for success in the modern business world. Embrace this change, and we can truly unlock the full potential of our businesses and economies.

For more go to: Business Engineering Systems: Pioneering a New Economic Frontier