'Insights from Davos Day 2' (see below) presentation from Martin Reeves,

Chairman of the Henderson Institute of BCG (Boston Consulting Group)

Main points (discussions at Davos)

- focus all stakeholders, rather than just shareholders.

- Broader concept needed (one that actually reshapes the system itself rather than measures things within the construct of the current system)

and how to solve such massive challenge in short time (manhattan project...)? - what are these special governance structures [for project (a) top down for direction AND (b) bottom up for content]?

- what's the system Re-Engineering formula that can move us forwards

Scroll down for video and transcript

Smart Economy: Re-Inventing and Re-Engineering s-'Line of Thoughts' in economics.

Insights and - as the result of any innovation process - methods, rules and tools are following experiences in real life.

They disrupt old views and enable higher levels of cognition and reasoning.

The economic development now is in the 'Smart Level' (blue). This needs a higher cognitive level (@ qualitative and quantitative dimension) and an enhanced logic and reasoning (MindWare for structuring and measuring real reality).

Nobody can successfully run a smart company where decision makers at any level are using obsolete MindWare that were developed for yesterday's economy.

(A) Design an enterprise model that fits your long-term vision. Based on existing assets (red, green, blue?).

(B) Determine how to get there and develop your resources (assets) and processes (including integral 'Hybrid Measures' for Stakeholders and Shareholders).

(Or would you plan a sightseeing tour in New York for 48 tourists with a map from 1776? The year Adam Smith published his book 'Wealth of Nations'.)

Below are listed some themes and focus points for explaining real reality in the three types of economy.

Be aware, that paradigms of older economic levels are not automatically obsolete in the newer economic level. It only has some limitations in 'usefulness'. And that is only bad if you use the older approach in an 'intelligent' system where intangible assets are playing a dominant role.

So, if you are running a system in the smart economy, you - and your decision makers - should better use an appropriate management system for a sustainable growth.

| # | Theme (in Theory) |

Pre-industrialized Economy | Industrialized Economy | Smart Economy |

|---|---|---|---|---|

| 1 | Production Capital | Land, Labour, Capital | Land, Labour, Capital | Land, Labour, Capital |

| 2 | Assets, resources | - tangible | - tangible - intangible |

- tangible - intangible - economic energy (concept of...) |

| 3 | Enterprise levels | One level: - Sale Products |

Two levels: 1. Sale (Products, Services) 2. Processes (Production) |

Three levels: 1. Sale (Products, Services) 2. Processes (R&D, Production...) 3. Prerequisites (Resources) |

| 4 | Offerings | - Physical Products | - Physical Products - Services |

- Physical Products - Services - Rights (Licenses...) - Shares |

| 5 | KPIs (value metrics) | - monetary measures [$, ...] | - monetary measures [$, ...] | - hybrid measures [$ AND i$] (monetary AND non-monetary) |

| 6 | ESG, UN SDGs | non-existent | - linear measures | - hybrid measures (vector based) |

| 7 | Economic Value Paradigm | Shareholder Value [$] | Shareholder Value [$] | - Enterprize Value [$ AND i$] - Shareholders Profit Expectation [i$] |

| 8 | Metrics | - linear | - linear | - hybrid (combines two or more dimensions) - winformation (weighted information) |

| 9 | Teachings | - Economics | - Economics - Business Administration |

- Economics - Business Administration - Business Engineering (Systems) |

'Insights from Davos Day 2' from Martin Reeves

Click on image for starting video or click here for original at Linkedin

Transcript:

In Davos this week there's a lot of focus on so-called multi stakeholder capitalism.

The idea that we need to focus on the interests of all stakeholders rather than just shareholders.

But I think this is a helpful construct because in a sense thinking about companies as economic islands that can maximize their profit locally has sort of created the externalities that create climate change and species loss and the other problems that got us to where we are today.

This particular focus on metrics the idea that if we measure the right things in the in the construct of multi stakeholder capitalism that we can somehow reunite the individual company interest with the broader social interest.

However in the different sessions this week I think there's a lot of tension around that concept and there were also many of the thought that we needed a broader concept. One that actually reshapes the system itself rather than measures things within the construct of the current system.

At dinner last night with business leaders I had a very fascinating discussion about what we can learn from history – from the few examples where many people came together to solve a massive challenge in a short space of time.

And I'm thinking about things like putting a man on the moon, or the Manhattan project, or the reconfiguration of the industrial base in the USA, the preparation for World War 2. And we discussed what are the common elements of that.

And the preliminary hypothesis was that the ingredients were:

- a big inspiring mission,

- a time constraint in a sense of urgency,

- and inspiring visionary leader that can communicate and motivate on that construct,

- a common enemy

and most certainly I think a project or program management structure that allows for Top down direction and inspiration, bottom up innovation and iteration, and also the coordination of many parties in a smooth manner, that doesn't tie itself in bureaucratic knots.

So this week in Davos I’m particularly interested in thinking about what are these special governance structures and what's the system Re-Engineering formula that can move us forwards.

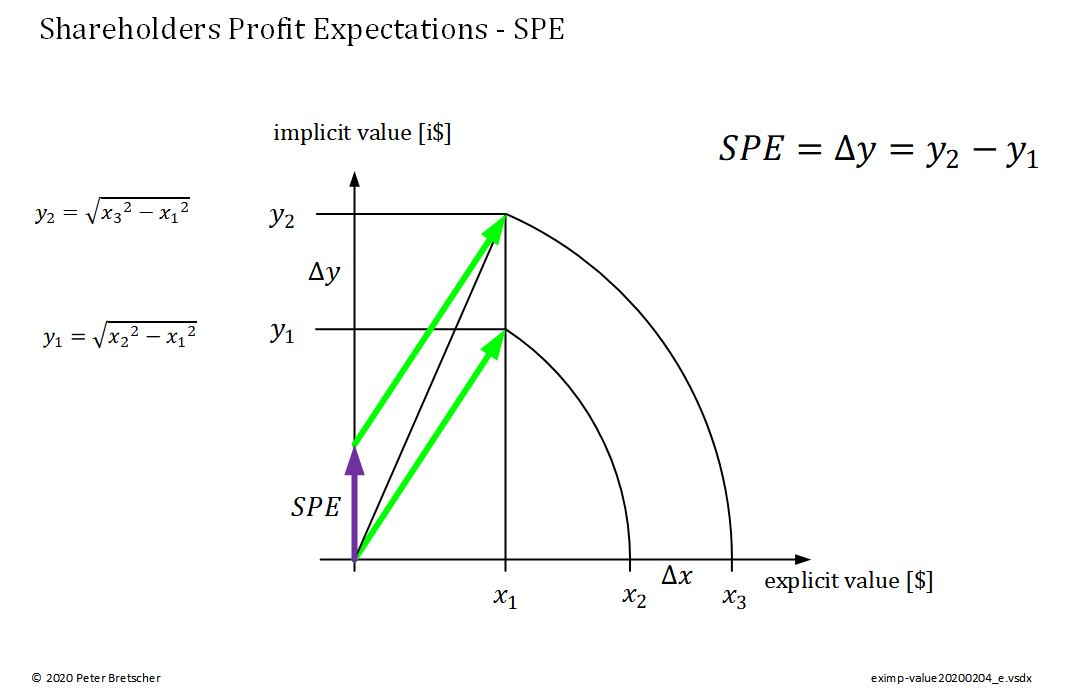

How to determine (incremental) Shareholders Profit Expectation

Formula 1 - Determining Shareholders Profit Expectation

Shareholders Profit Expectation (SPE) drives rally at stock exchange.

Hybrid Vector based Value Indicators:

Introducing the Shareholders Profit Expectation allows to differ between (A) the Value of the Company and (B) the Value of the Share.

Needed for calculation:

- Indicator #1 is the $-priced asset in the balance sheet.

- Indicator #2 is the 'SharePrice1' at a specific time.

- Indicator #3 is the 'SharePrice2' at a later time.

The formula for SPE is on the picture on the left side.

Green vectors are the combination of the value of the enterprise at the starting time.

The purple vector shows the SPE as 'imginary', 'implicit' Profit expectation from shareholder.

Use interactive Excel Sheet below for your own calculations.

Purpose of 'Project NEMO' (New/Next Economic Model) is to enhance classic economics by

(i) including intangible assets as the common source of welfare and wealth and

(ii) disclosing a vector based hybrid value principle enabling monetary AND nonmonetary dimensions as a compound/hybrid measure.