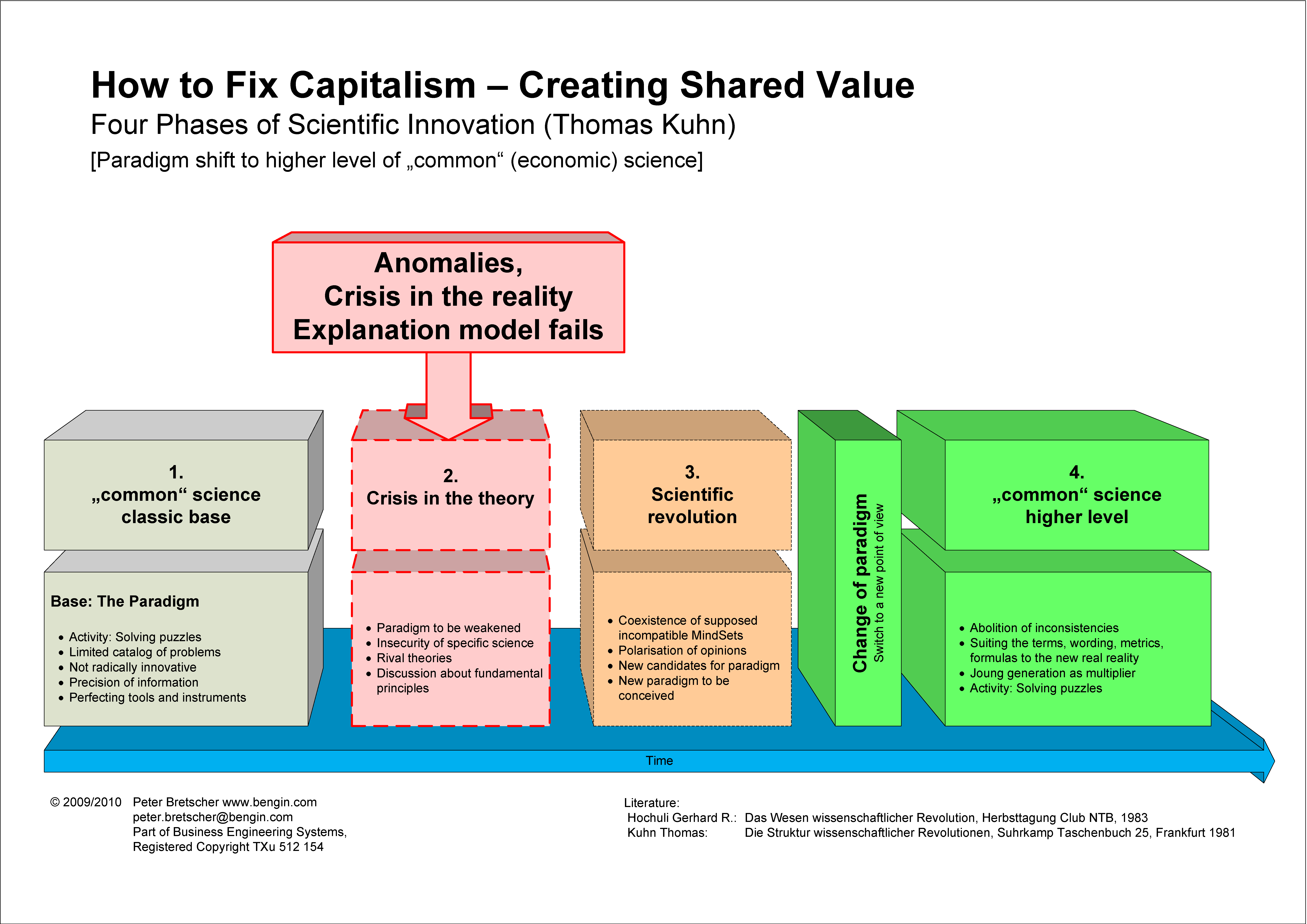

Beyond dead end of economist’s classic mindware and other tools.

(click on pic)

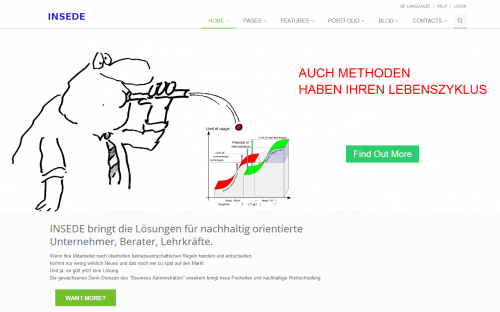

Auch (BWL) Methoden veralten, werden verbessert und abgelöst.

Eigentlich sind auch Methoden letztendlich Produkte, wenn auch nicht wirklich fassbar wie zum Beispiel eine Dampfmaschine.

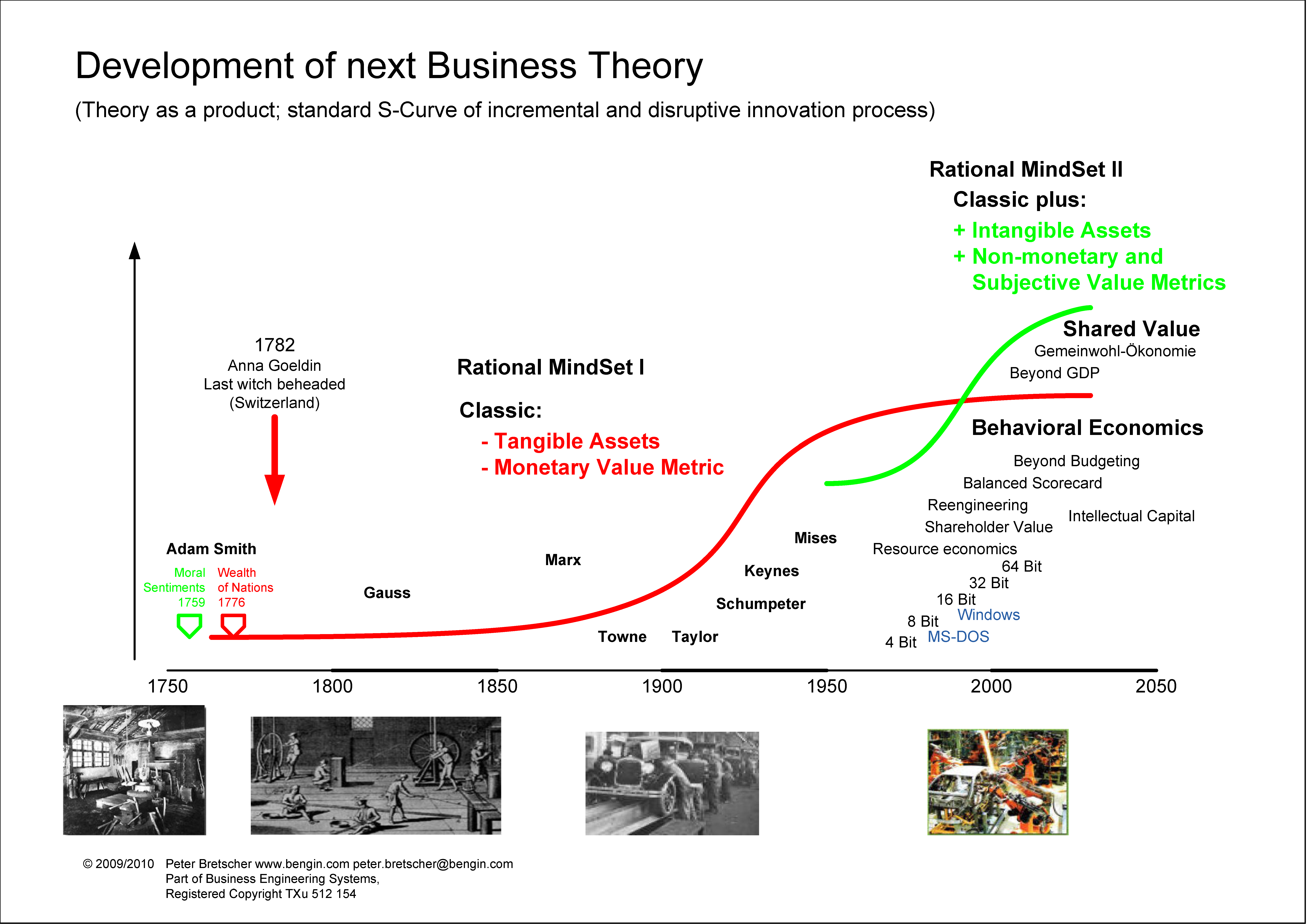

Methoden als geistige Produkte haben aber auch ihren Lebenszyklus. Besonders eindrücklich wird das, wenn man sich die Methoden der Wirtschaftslehre betrachtet. Haben sie doch ihren Ursprung vor über 200 Jahren, als man in Europa noch Hexen verbrannte und die durchschnittliche Lebenserwartung in England noch unter 40 Jahren war.

Wenn man nun alte Methoden in neuen Realitäten anwendet, merkt man dann irgendwann, dass man die Methoden den neuen Anforderungen anpassen sollte.

Die Einen merken es etwas füher, die Anderen etwas später. Ja klar, auch wenn man’s weiss, heisst das noch lange nicht, dass man die Methoden (Produkte, Werkzeuge, Prozesse, Konstruktionen…) dann auch wirklich anpasst.

Schliesslich konnte VW ja auch noch lange Jahre den Käfer verkaufen, auch wenn die Konkurrenz schon lange modernere Autos mit Vorderradantrieb anbot. Und bei den Lehren gibt’s ja so viele alt bewährte Lehrmittel. Warum denn neue schreiben, wenn sich das Alte ja noch gut verkaufen lässt? Schliesslich werden die Studenten ja geprüft, ob sie die alten Methoden und Techniken verstanden haben. Die berühmten „Credits“ gibt’s ja nur für das Lösen von alten Prüfungsaufgaben.

INSEDE (Institute for Sustainable Economic Development) hat da einen etwas anderen Ansatz.

Viele Erfindungen und Neuerungen in der realen Welt haben ihren Ursprung darin, dass ganz praktisch für ein reales Problem eine praktische Lösung oder ein besseres Erklärungsmodell gefunden werden musste. Und vielfach mussten dazu von der „klassischen Lehre“ verbotene und unwissenschaftliche Wege beschritten werden. So erfand beispielsweise der belgische Chemiker Leo Hendrik Baekeland den duroplastischen Kunststoff gerade WEIL er sich nicht an die Regeln der gesicherten Chemischen Wissenschaften gehalten hat. Später hat dann die Wissenschaft ihr Erklärungsmodell ergänzt.

Praktiker in Wirtschaft und Politik sehen sich auch zunehmend mit dem Problem konfrontiert, dass die Methoden der Wirtschatswissenschaft in vielen Belangen den Anforderungen nicht mehr genügen.

INSEDE geht darum von den Problemen in der Praxis aus und entwickelt Modelle, die den Anforderungen besser gerecht werden. Und dies ohne dass faule Kompromisse an alte Lehrmeinungen gemacht werden müssen. Schliesslich sind ja die meisten der Wirtschaftseinsichten und Theorien unter völlig anderen wirtschaftlichen und gesellschaftlichen Rahmenbedingungen entstanden.

INSEDE ist aber auch ein „offenes Institut“.

Wir gehen davon aus, dass viele Menschen in der Realität mit dem Unterschied zwischen Theorie und Praxis (Strategie und Operationalisierung, Regeln und Machbarkeit….) konfrontiert sind. Und dass Reale und praktikable Lösungen existieren, die in den „Elfenbeintürmen“ noch nicht bekannt sind.

Wir sind daher interessiert an Kontakten zu Menschen, die mithelfen, ein besseres Erklärungsmodell, eine bessere Wirtschaftstheorie zu entwickeln.

INSEDE verfügt über Entwicklungs-Vorleistungen von über CHF 4.5 Mio, abgesichert durch ein registriertes Urheberrecht, über das wir frei verfügen können.

Praktiker und Theoretiker sind eingeladen, von diesen Vorleistungen zu profitieren und ihrerseits derivative Lösungen (mit eigenem Urheberrecht) zu schaffen.

Bei Interessen können Sie sich unverbindlich über das Formular der neuen INSEDE Website mit uns in Verbindung setzen.

http://insede.org

Project NEMO (New/Next Economic Model)

Nach 200 Jahren ist es wohl an der Zeit, die ökonomischen Modelle den heutigen Realitäten anzupassen.

Darum: Projekt NEMO.

Jetzt mitmachen und die Modelle mit Erkenntnissen aus der Praxis verbessern.

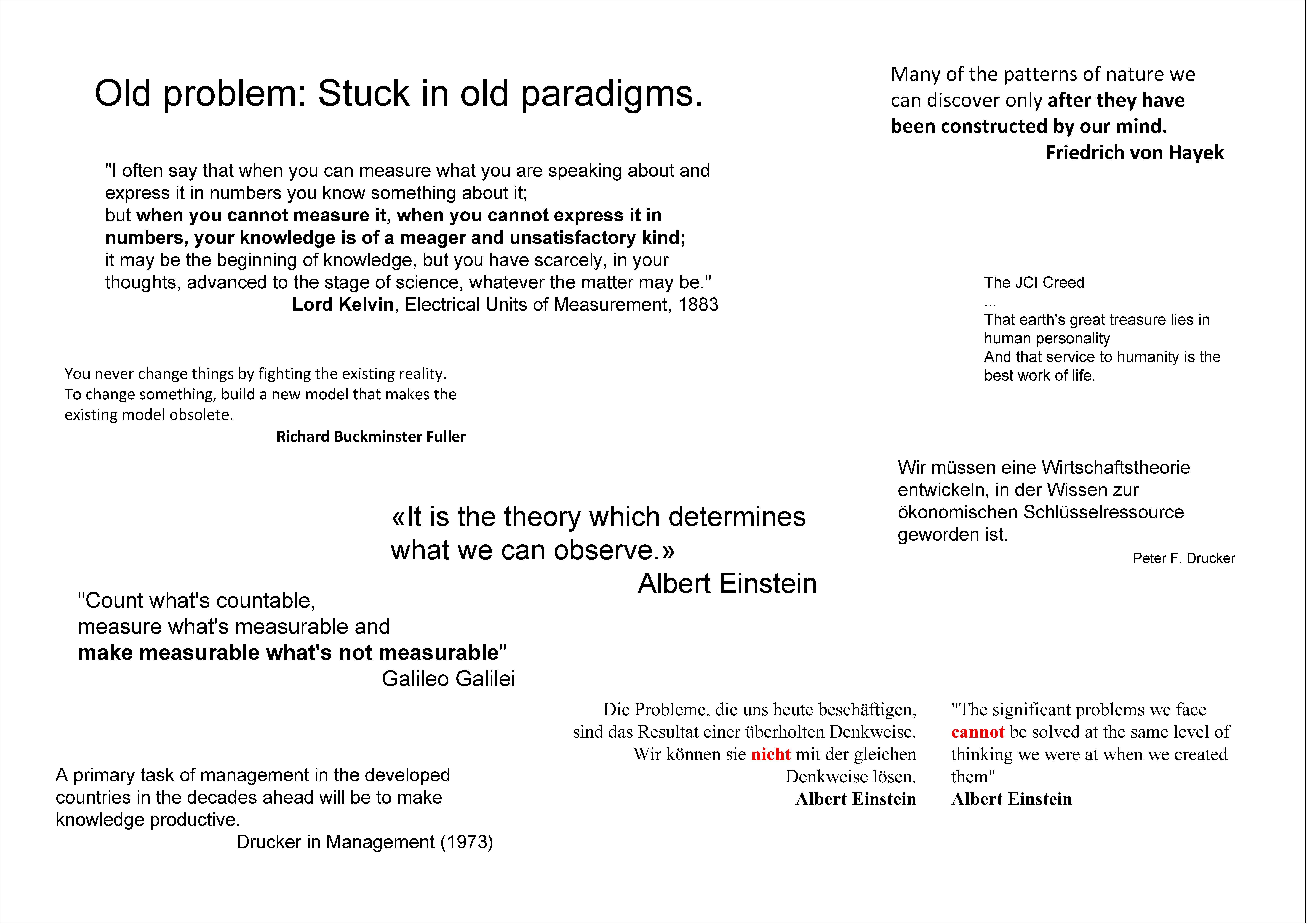

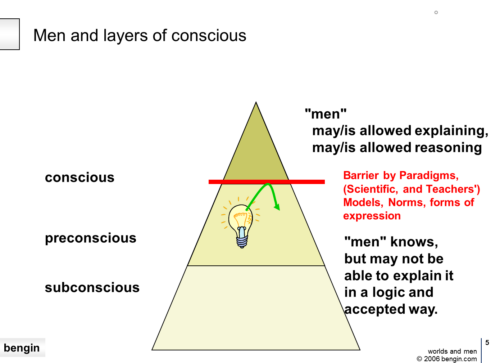

We (anyone) know more than we

We (anyone) know more than we

We (anyone) know more than we

a) are able to say, because words are missing – or

b) may say (are allowed to say) because it doesn’t comply with classical dogmas and or other rules.

Disruptive #innovations are only effective if we succeed in cracking or bypassing such barriers between the „preconscious“ and „conscious“ level of understanding.

We have developed solutions (tools, visualizations…) to overcome those barriers that traditional economics (paradigms) are hindering us to express the experienced real reality we are living in and are filtered out in classic “Economic Theory”.

Using this bypass gives management unexpected new freedom, creating integral value (internal AND external, tangible AND intangible, monetary AND non-monetary, social AND economic, …) in order to run a more sustainable enterprise.

http://bengin.net/paperse/worlds_and_men010_e.ppt

#businessengineering #sharedvalue #bteam #insede #innovation #thirdmetric

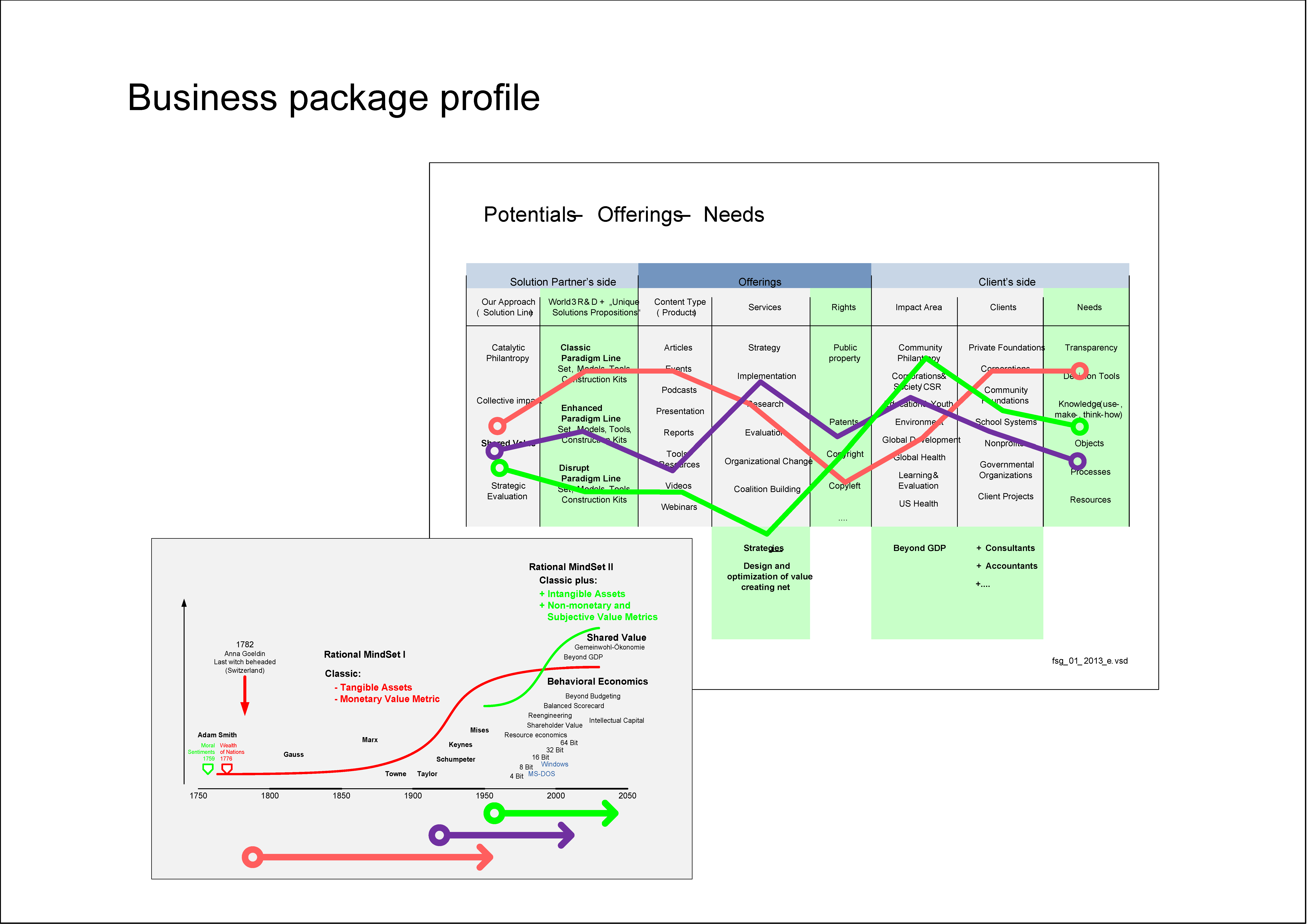

Business Engineering Systems discloses economic Potential(s).

Business Engineering Systems discloses economic Potential(s).

Business Engineering Systems discloses economic Potential(s).

Mainly based on intellectual capital.

Originally shared by Peter Bretscher

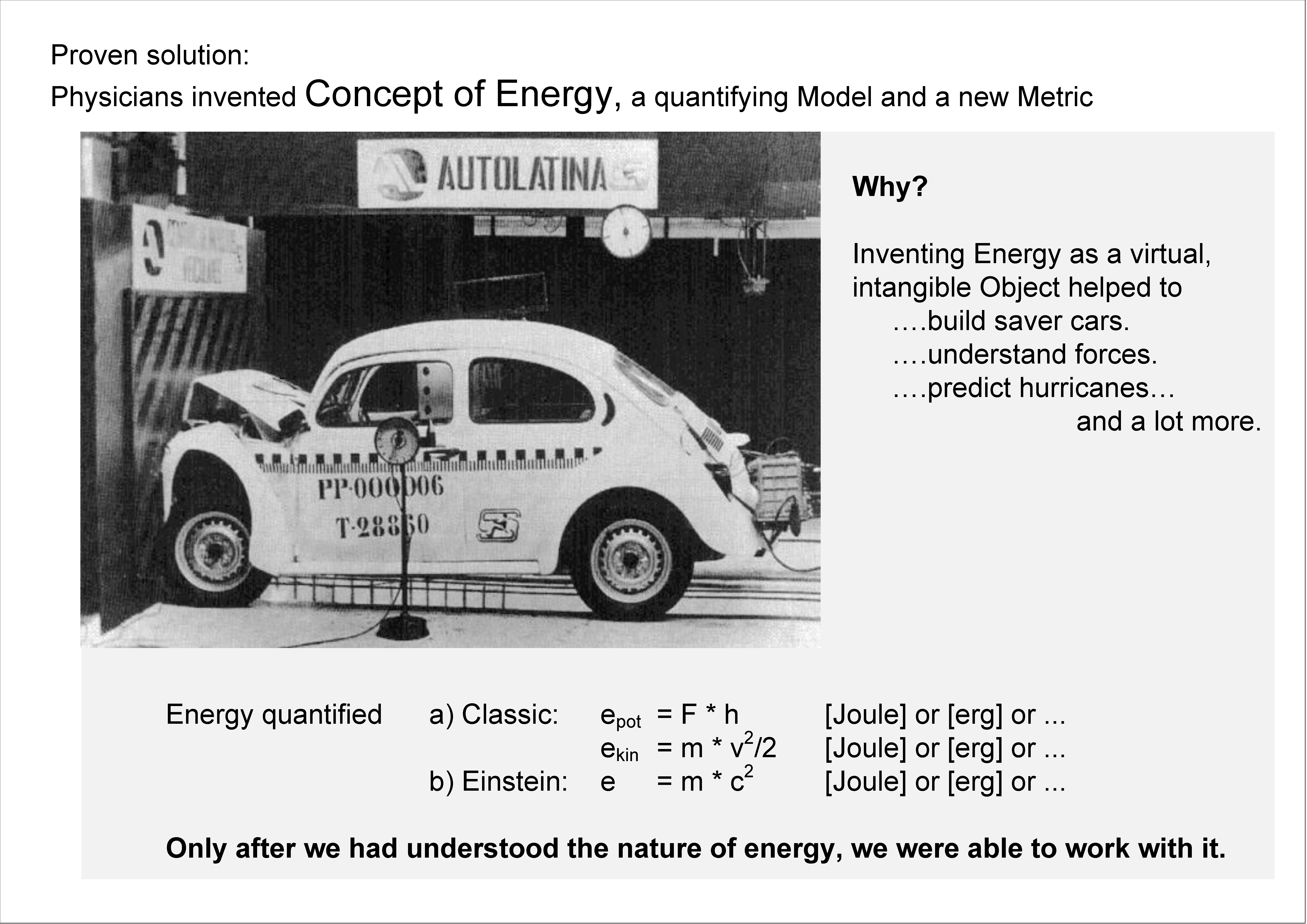

Who’s afraid of imaging the economic potential? How to map and measure it?

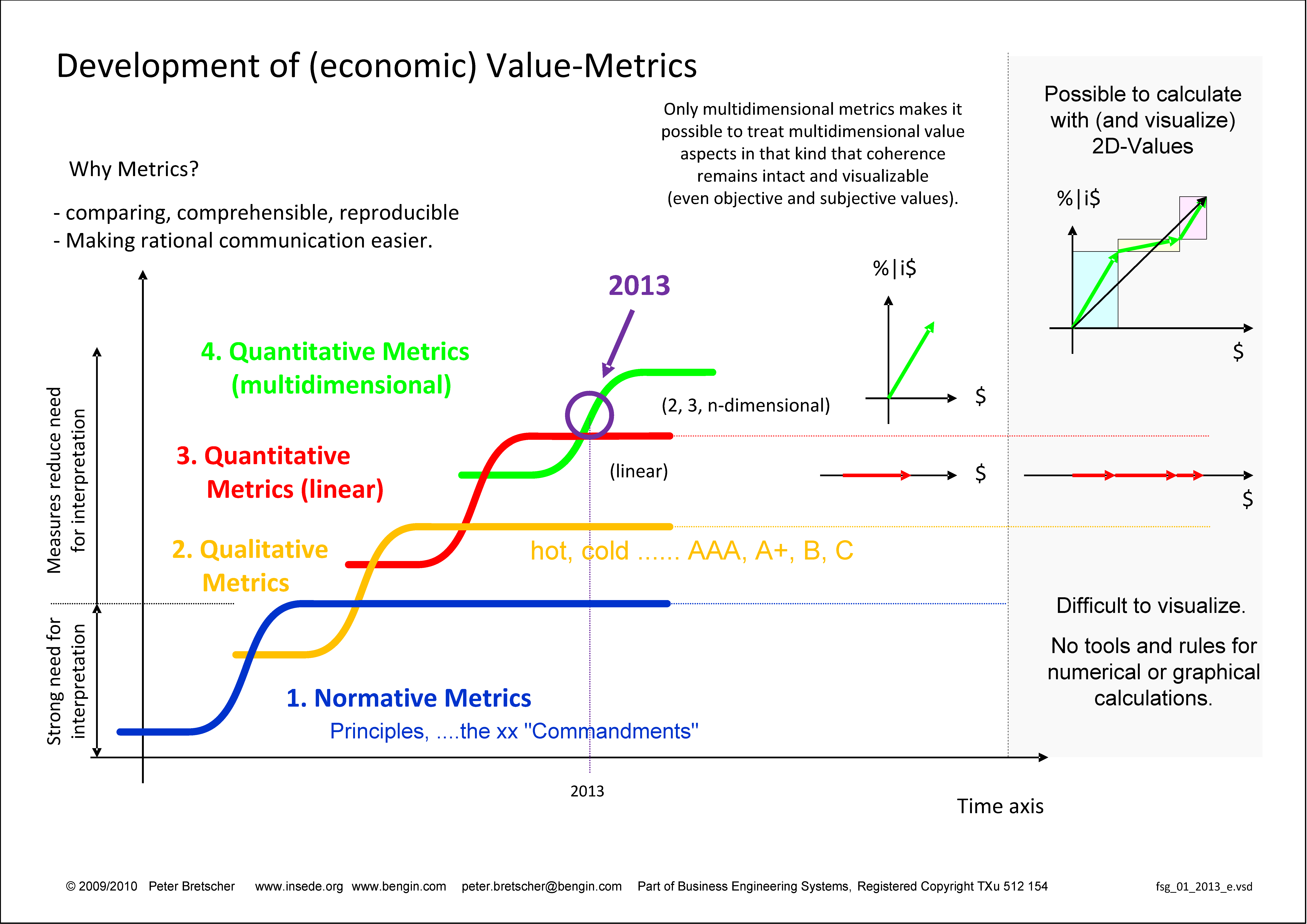

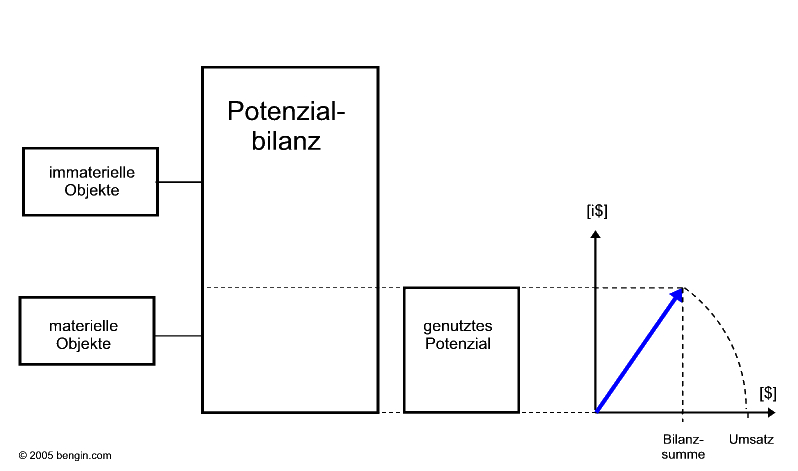

Potential cannot be measured directly, but determined ( = calculate ).

Analogously, as for example, the potential or kinetic energy ( in physics ) is not measured, but it can be calculated / determined.

There are several ways to determine the potential(s).

Basically, the potential itself does NOT have a monetary unit and is drawn perpendicular to the axis of money. In the picture below the unit is [i$]. Letter “i” stands for „implicit / imaginary“.

To calculate the economic potential, it needs two monetary points (Pythagoras).

The picture shows an example of the calculation of the potential based on assets and sales in [$].

But it could also be payroll and sales, project costs and expected revenues, pizza price in a discount store and a pizzeria, total assets and market capitalization….

Using this principle – and correction factors – is it possible to create a balance sheet of the potential…

In addition there’s quite a lot more basics, for example on YouTube:

Mapping Intangible Assets too – beyond classic economic mindset:

Mapping Intangible Assets too – beyond classic economic mindset

Economic Value Architecture and Engineering 2012 alpha:

Economic Value Architecture and Engineering 2012 alpha

Strategic Potential and Performance Quadrants (explicit meets implicit):

Strategic Potential and Performance Quadrants (explicit meets implicit)

Or in general:

http://www.youtube.com/peterbretscher

There are „silent movies“ – Notes and links for download pdf are in the „Info“ part of the movies.

#businessengineering #thirdmetric #sharedvalue #bteam

Wie die Potenziale in einer Unternehmung messen?

Wie Potenzial messen?

Potenzial lässt sich nicht direkt messen, aber bestimmen (= berechnen).

Wie sich beispielsweise auch die potenzielle oder die kinetische Energie (in der Physik) nicht messen, aber bestimmen/berechnen lassen.

Es gibt mehrere Arten, das Potenzial zu bestimmen.

Grundsätzlich gilt, dass das Potenzial NICHT eine monetäre Einheit hat und senkrecht zur Geldachse gezeichnet wird. Im Bild unten mit der Einheit [i$] für „implizit/imaginär“.

Aus zwei monetären Stützpunkten wird das Potenzial bestimmt (Pythagoras).

In Bild ein Beispiel für die Potenzialberechnung aus der Bilanzsumme und dem Umsatz.

Es könnten aber auch Lohnsumme und Umsatz; Projektkosten und erwartete Erträge; Pizzapreis bei Aldi und in der Pizzeria; Bilanzsumme und Börsenkapitalisierung sein….

Mit diesem Prinzip – und Korrekturfaktoren – ist es dann möglich, eine Potenzialbilanz zu erstellen…

Dazu gibt’s relativ viel weitere Grundlagen, zum Beispiel auf Youtube:

Mapping Intangible Assets too – beyond classic economic mindset

Economic Value Architecture and Engineering 2012 alpha

Strategic Potential and Performance Quadrants (explicit meets implicit)

Oder generell:

http://www.youtube.com/peterbretscher

Es sind „Stummfilme“ – Erläuterungen und Links sind im „Info-Teil“ unter den Filmen.

Vorhandene Potenziale erkennen und besser nutzen.

You get what you imagine – not what you see

Wir wissen mehr, als wir

Wir wissen mehr, als wir

Wir wissen mehr, als wir

(a) sagen können, weil die Worte fehlen – oder

(b) sagen dürfen, weil sie klassischen Lehrmeinungen oder anderen Regeln nicht entsprechen.

Disruptive #Innovationen werden dann wirksam, wenn es gelingt, solche Sperren zwischen dem „Vorbewussten“ und dem „Bewussten“ zu knacken.

Wir haben Lösungen entwickelt, mit denen solche Sperren der tradierten Wirtschaftswissenschaften (Paradigmen) abgebrochen werden.

Das gibt dem Management neue Freiheiten, ganzheitliche Wertschöpfung (intern und extern) zu betreiben und auszuweisen.

https://bengin.net/papersd/welten_und_mensch010_d.ppt

Zum Thema Intuition im Unternehmen:

von +Andreas Zeuch https://plus.google.com/u/0/116953204951870707574/posts/g5JGXfysMs8

#Businessengineering #Sharedvalue

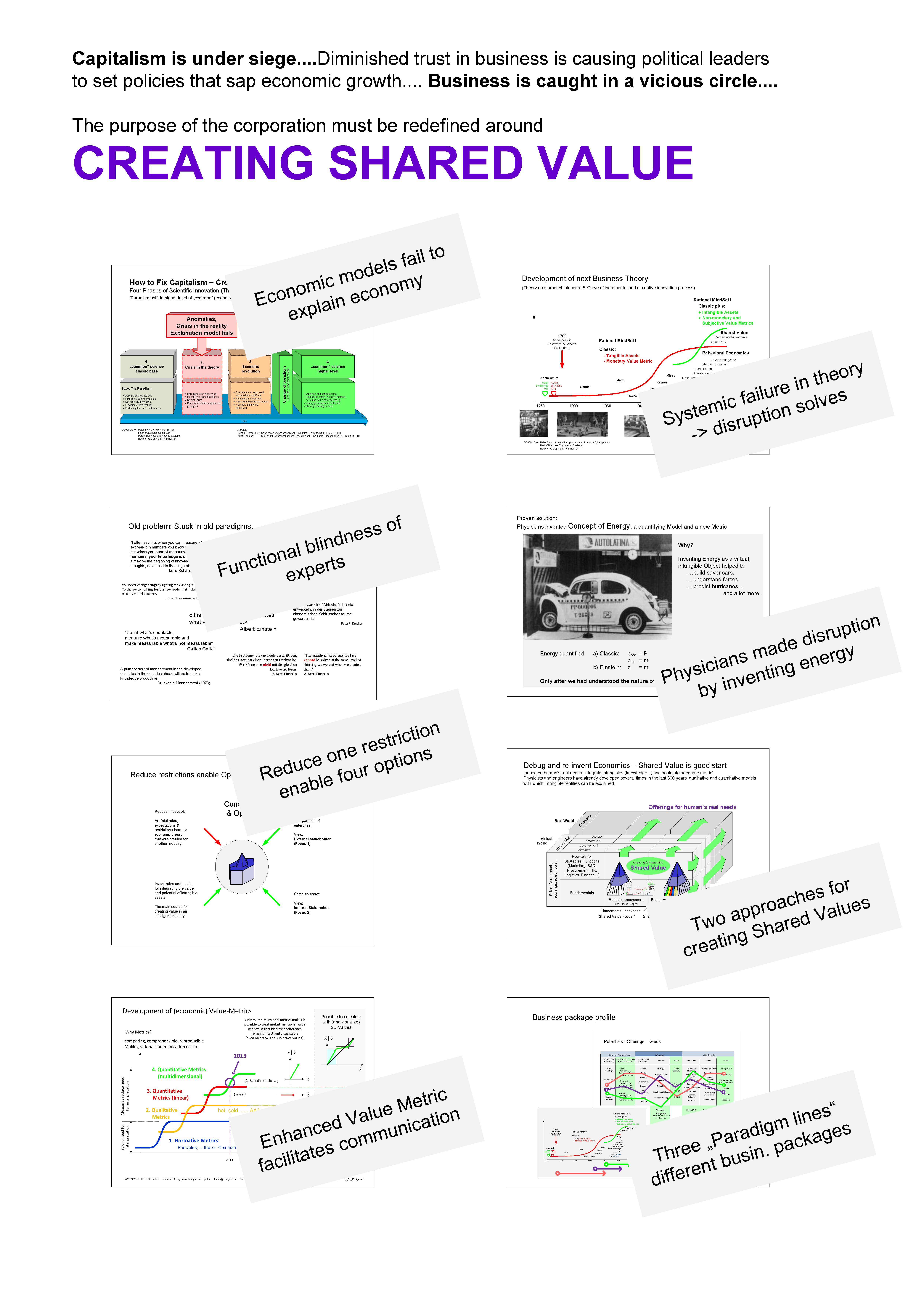

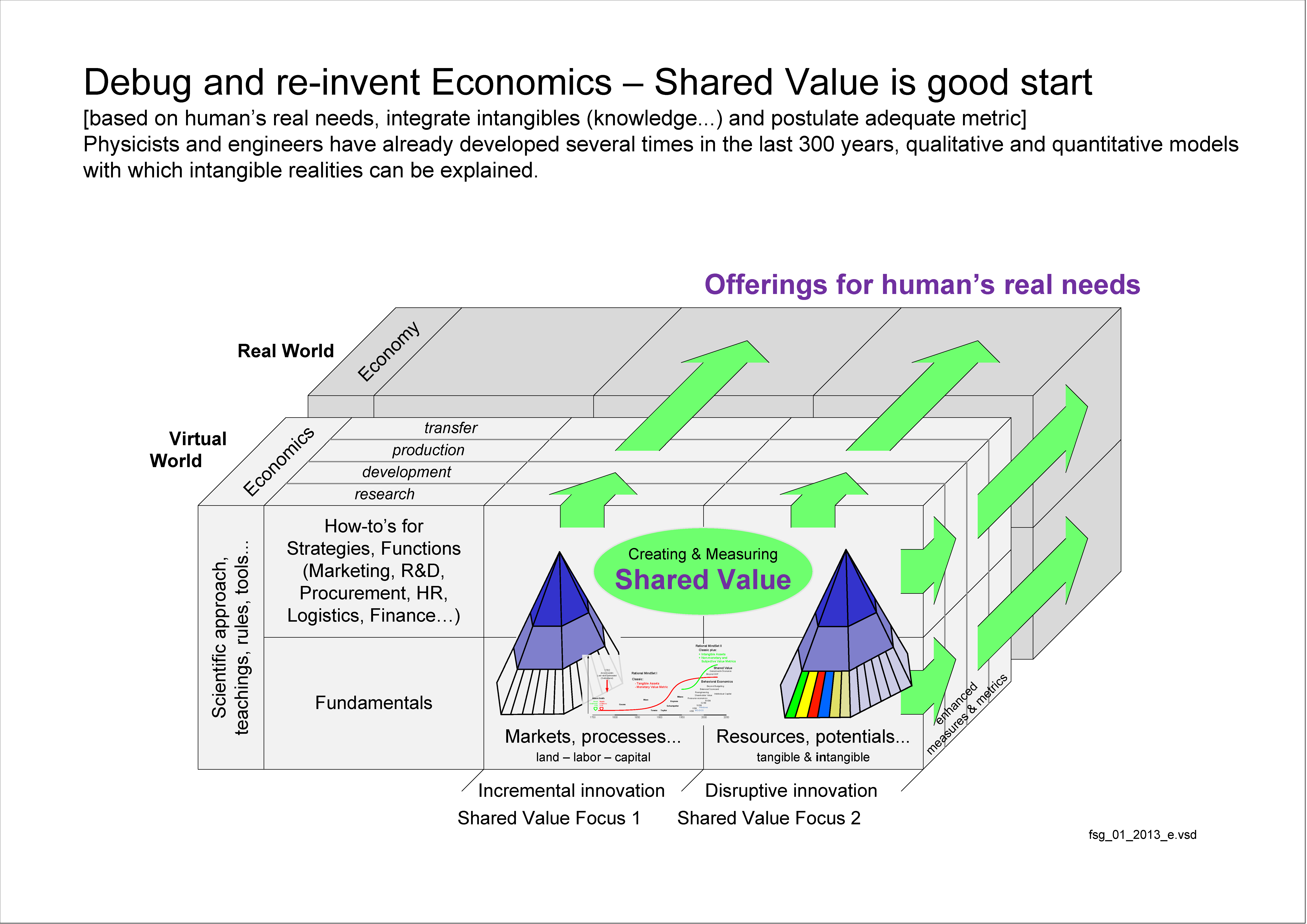

Time to Reengineer Economics (the models, the theory) – with Original Business Engineering – the solution that makes…

Time to Reengineer Economics (the models, the theory) – with Original Business Engineering – the solution that makes…

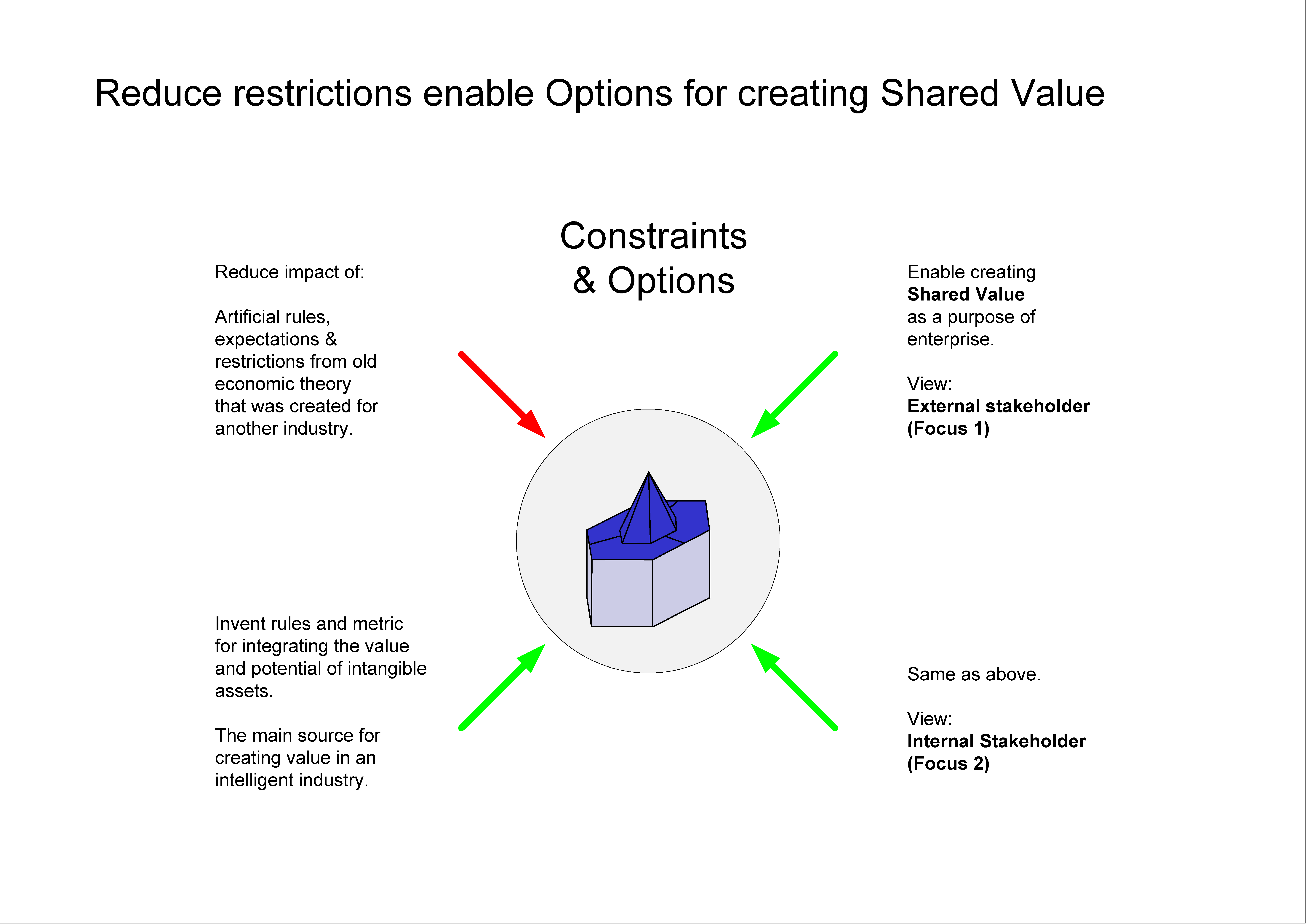

Time to Reengineer Economics (the models, the theory) – with Original Business Engineering – the solution that makes Business Administration integral

Only original and authentic:

a) if & when it is potential-oriented.

Base of next model not only considers tangibles, but also the intangible resources / potentials.

b) if & when old values paradigm / metrics expands.

Next value paradigm / metrics measures and visualizes monetary AND nonmonetary value indicators. Simultaneously (Vector Value Metric).

Everything else is facade painting.

Pictures download as pdf: http://bengin.net/dl13/howto_create_sv_01_2013_e.pdf

#thirdmetric #sharedvalue #bteam

Originally shared by Peter Bretscher

Time to Reengineer Economics (the models, the theory) – with Original Business Engineering – the solution that makes Business Administration integral

Only original and authentic:

a) if & when it is potential-oriented.

Base of next model not only considers tangibles, but also the intangible resources / potentials.

b) if & when old values paradigm / metrics expands.

Next value paradigm / metrics measures and visualizes monetary AND nonmonetary value indicators. Simultaneously (Vector Value Metric).

Everything else is facade painting.

Pictures download as pdf: http://bengin.net/dl13/howto_create_sv_01_2013_e.pdf

#thirdmetric #sharedvalue #bteam