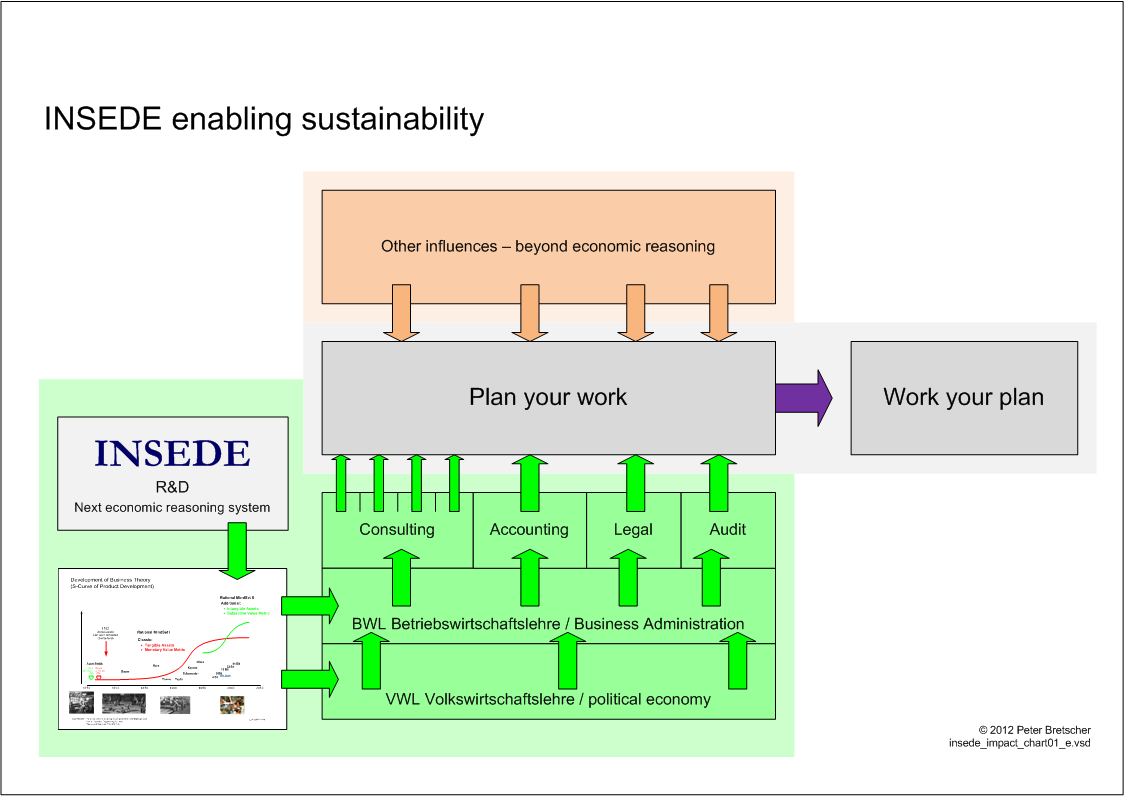

Originally shared by Peter Bretscher

OECD – New Sources of Growth – Knowledge-Based Capital – Intangible Assets

Investment and growth in OECD economies is increasingly driven by intangible or knowledge-based capital (KBC). In many OECD countries, firms now invest as much or more in KBC as they do in physical capital such as machinery, equipment and buildings. To address the rise of KBC – and contributing to the OECD’s work on new approaches to economic challenges – the OECD has embarked on a two-year horizontal project entitled „New Sources of Growth: Intangible Assets“…..

http://www.oecd.org/document/5/0,3746,en_2649_201185_46605957_1_1_1_1,00.html

http://www.oecd.org/document/5/0,3746,en_2649_201185_46605957_1_1_1_1,00.html